riverside mo sales tax rate

With local taxes the total sales tax rate is between 4225 and 10350. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Riverside MO.

Enter your street address and city or zip code to view the sales and use tax rate information for your address.

. The local sales tax rate in Kansas City Missouri is 885 as of January 2022. The minimum combined 2022 sales tax rate for Riverside California is. The Riverside Missouri Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside Missouri in the USA using average Sales Tax Rates andor.

Missouri MO Sales Tax Rates by City R The state sales tax rate in Missouri is 4225. You can find more tax rates and. Riverside is located within Platte County.

2022 List of Missouri Local Sales Tax Rates. State Tax Rates. Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237.

Ad Get Missouri Tax Rate By Zip. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county. The minimum combined 2022 sales tax rate for Riverside Missouri is.

What is the sales tax rate in Riverside Missouri. Riverview Estates MO Sales Tax Rate. Over the past year there have been 80 local sales tax rate changes in Missouri.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. Fortescue MO Sales Tax Rate. The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a.

The state sales tax rate is 4225. Local tax rates in. This rate includes any state county city and local sales taxes.

Free Unlimited Searches Try Now. The average cumulative sales tax rate in Riverside Missouri is 71. You can print a.

Average Sales Tax With Local. Indicates required field. 2020 rates included for use while preparing your income tax deduction.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. What is the sales tax rate in Riverside California. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax.

An alternative sales tax rate of 885 applies in the tax region Kansas City which appertains to zip code 64150. The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales tax and 238 Riverside local sales taxesThe local sales tax consists of a 138 county sales tax and. This is the total of state county and city sales tax rates.

This includes the rates on the state county city and special levels. The Riverside Missouri sales tax rate of 71 applies in the zip code 64150. The latest sales tax rate for Cameron MO.

In Riverside Missouri Sales tax rate in Riverside Missouri is 6600. Find Sales and Use Tax Rates. Cities counties and certain districts may also impose local sales taxes as well so the amount of tax sellers collect from the purchaser depends on the.

This is the total of state county and city sales tax rates.

Missouri Sales Tax Guide For Businesses

Missouri Sales Use Tax Guide Avalara

Sales Tax Rates In Major Cities Tax Data Tax Foundation

![]()

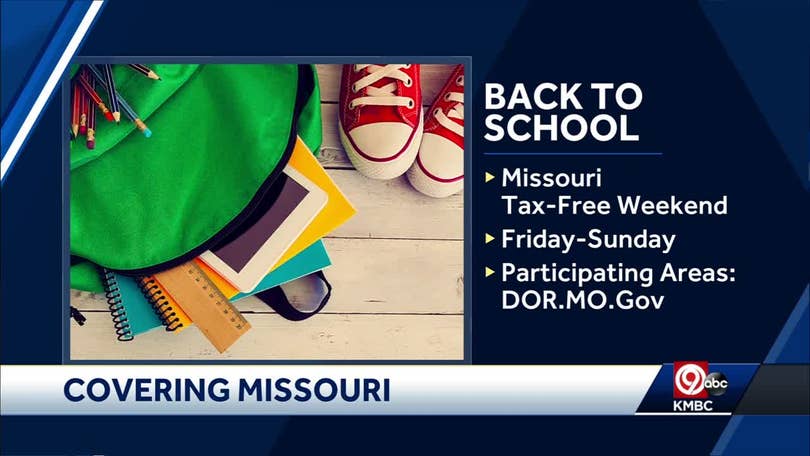

Missouri Sales Tax Holiday Begins Aug 5 The Beacon

Kansas Sales Tax Rates By City County 2022

Missouri Income Tax Calculator Smartasset

Will Your Taxes Increase Tax Issues On Kc Area Ballots

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Missouri Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Missouri Tax Free Weekend 2022 Kansas City

Missouri Car Sales Tax Calculator

Missouri Sales Tax Rates By City County 2022